餐飲資訊

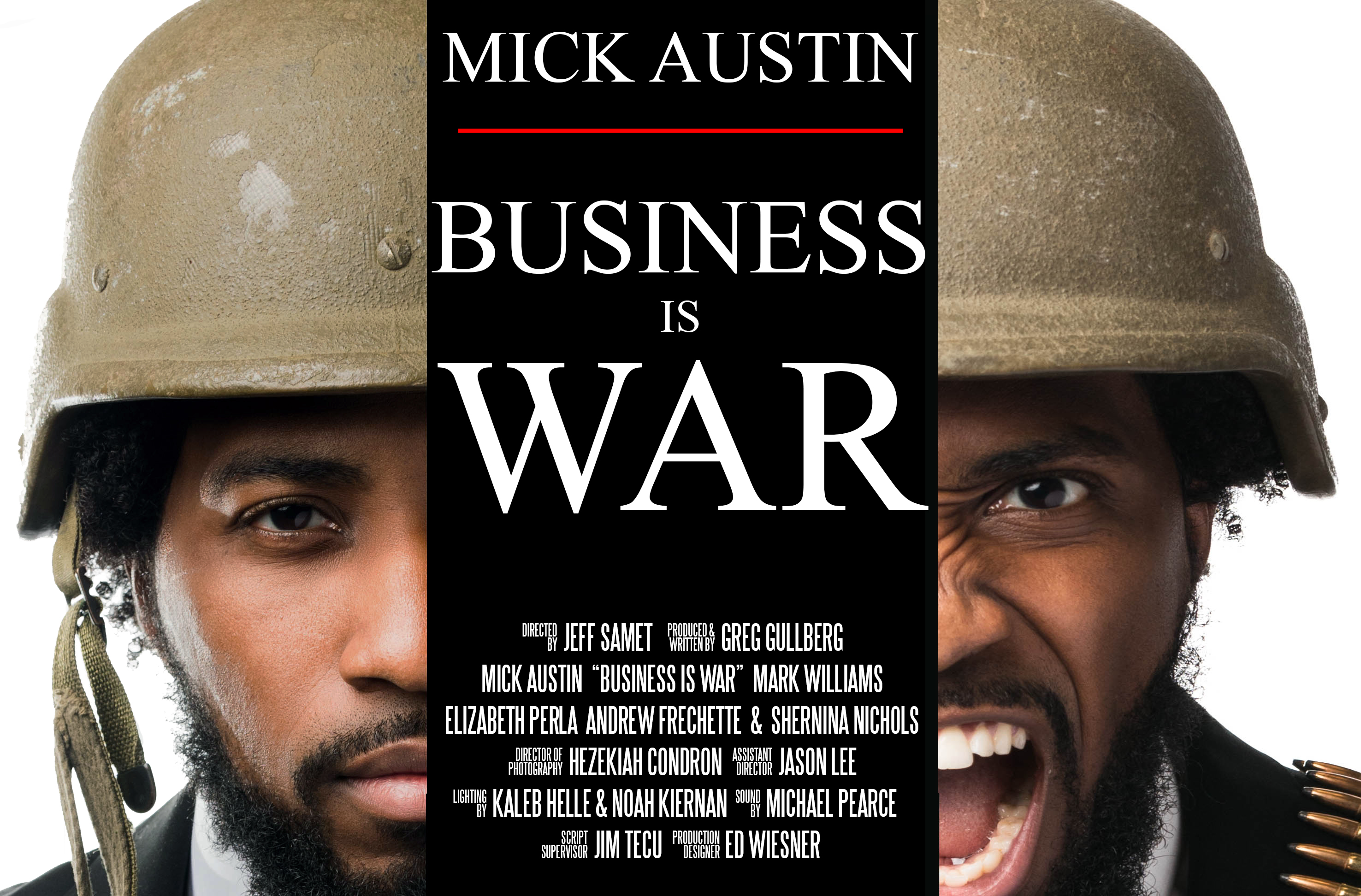

小編學做生意,不時會參考孫子兵法的謀略,有三點深受影響。

#用一線兵打二線位 要做生意,展開戰爭,就要計算兵力多少?糧草足夠?「地勢」是否有利於我方?以及敵方的優劣。明知冇可能跟大行對抗,反之集中兵力,用一線兵打二線位。但一旦對手巳重兵進駐二線位,人優我走,可能被迫要找尋另一條戰線。

#搵市場虛位突擊 綜觀今天局勢,餐飲頂讓變成兵家必爭之地,兩間大行,油尖旺多間老牌旺鋪,兩間中環代理行,幾廿間生意頂讓公司,重有打單炮的 sales,如果跟行家的模式,市場「通盤」走,必敗無疑。 唯有找出市場被忽略/不會/不想做的「戰線」,亦即市場虛位,繼而集中火力強攻那一點,成功後再extend 戰線。

#農村包圍城市 換言之,如果小編開餐廳,會盡量先揀屋村/二,三線民生位,農村包圍城市,競爭對手不能太強,租金不能太貴,要穩守先可以突擊,市場上成功突圍的餐廳,都有一套戰略。 代理行業,祥益老闆汪總幾乎係近十幾年黎最成功發揮孫子兵法精神的例子。美容行業,以琥珀美容為例,新界累積足夠實力後,不斷向外拓展,它揀的地點都是實而不華,可以打持久戰,今年貴公司殺入中路,進駐旺角朗豪坊,絕對是一個很成功的案例。

#用一線兵打二線位 要做生意,展開戰爭,就要計算兵力多少?糧草足夠?「地勢」是否有利於我方?以及敵方的優劣。明知冇可能跟大行對抗,反之集中兵力,用一線兵打二線位。但一旦對手巳重兵進駐二線位,人優我走,可能被迫要找尋另一條戰線。

#搵市場虛位突擊 綜觀今天局勢,餐飲頂讓變成兵家必爭之地,兩間大行,油尖旺多間老牌旺鋪,兩間中環代理行,幾廿間生意頂讓公司,重有打單炮的 sales,如果跟行家的模式,市場「通盤」走,必敗無疑。 唯有找出市場被忽略/不會/不想做的「戰線」,亦即市場虛位,繼而集中火力強攻那一點,成功後再extend 戰線。

#農村包圍城市 換言之,如果小編開餐廳,會盡量先揀屋村/二,三線民生位,農村包圍城市,競爭對手不能太強,租金不能太貴,要穩守先可以突擊,市場上成功突圍的餐廳,都有一套戰略。 代理行業,祥益老闆汪總幾乎係近十幾年黎最成功發揮孫子兵法精神的例子。美容行業,以琥珀美容為例,新界累積足夠實力後,不斷向外拓展,它揀的地點都是實而不華,可以打持久戰,今年貴公司殺入中路,進駐旺角朗豪坊,絕對是一個很成功的案例。

Market Segmentation 中文譯成-市場區隔,背後隱含訊息,市場上巳有巨人壟斷大市場,新晉的商家只能選擇某個戰線。

以下係小編透過現實環境,觀察出來的4個細分市場例子,市場唔一定係指人,可以係地理,服務。

係使用者方面,Facebook 係全球最大社交平台,linkedin 反行其道 專注「求職領域」,再細分三大target audience,HR, 廣告商跟求職者。

係產品訂價方面,百佳惠康壟斷大眾超市,佳寶向下突擊賣平價貨品,city'super 就走高檔路線,避免直接價格競爭。

係地理位置方面,中原美聯壟斷全港住宅?不少細行反行其道專注一區,成功「霸佔山頭」,最成功例子莫過於係祥益地產,集中打新界西,當年更得「居屋王」美喻。

係服務方面,香港幾間上市美容集團,其他美容院仍可以專注「單一服務」,成為某個領域專家,成功擴展幾間分店的,不計其數。

美容院有「特色」的,一樣有機會彈起

以下係小編透過現實環境,觀察出來的4個細分市場例子,市場唔一定係指人,可以係地理,服務。

係使用者方面,Facebook 係全球最大社交平台,linkedin 反行其道 專注「求職領域」,再細分三大target audience,HR, 廣告商跟求職者。

係產品訂價方面,百佳惠康壟斷大眾超市,佳寶向下突擊賣平價貨品,city'super 就走高檔路線,避免直接價格競爭。

係地理位置方面,中原美聯壟斷全港住宅?不少細行反行其道專注一區,成功「霸佔山頭」,最成功例子莫過於係祥益地產,集中打新界西,當年更得「居屋王」美喻。

係服務方面,香港幾間上市美容集團,其他美容院仍可以專注「單一服務」,成為某個領域專家,成功擴展幾間分店的,不計其數。

美容院有「特色」的,一樣有機會彈起

問題:除了創立一盤新的生意,我可以購買已在運作中的業務嗎?如果我打算那樣做,要注意甚麼呢?

回答:創辦小型企業可能是一個富有挑戰性和令人興奮的體驗。但是閣下不妨考慮不要從零開始建立業務,而是購買現有並已在運作中的業務。 收購現有並已在運作中的業務,優勢是顯而易見的。

僅舉幾例:產品或服務已經在市場上,品牌可能已成熟,啟動時間可以顯著縮短,可能更容易獲得融資,已有穩健的客戶群等。買方只需評估它願意為收購業務付出多少,並找到一個願意以雙方同意的價格出售業務的賣家。 收購現有業務最直接的方式是收購經營該業務的公司的所有股份。公司的全部權利、義務和責任將由買方承擔。當然,買方必須對目標公司進行盡職調查,以確保它購買的業務確屬其真正所需。然後,雙方應達成股份買賣協議,以釐定股份價格、成交日期、賣方的擔保和陳述、納稅彌償責任、賣方責任上限等事項。視乎目標公司的規模和運作複雜性,整個買賣過程可能非常複雜需要數個月才能完成。如果沒有專業協助,要完成整個買賣過程並非易事。因此,如果買方和賣方不委聘會計師和律師等專業人員參與工作,他們將承擔相當大的風險。

Question : INSTEAD OF SETTING UP A NEW BUSINESS, CAN I ACQUIRE AN ON-GOING BUSINESS? WHAT DO I HAVE TO BEAR IN MIND IF I INTEND TO DO THAT? Answer : Starting a small business can be a challenging and exciting experience. However, rather than building a business from ground zero, you may consider purchasing an existing and on-going one. The advantages of acquiring an existing and on-going business are obvious. Just to name a few: the product or service is already on the market, the brand is probably well established, startup time can be significantly reduced, it is probably much easier to obtain financing, access to customer base is secured, etc. The purchaser just has to evaluate how much it is willing to pay for the business and find a seller who is willing to sell at a mutually agreed price. The most straight forward way to acquire an on-going business is to acquire all the shares in the company which runs that business. The company’s entire rights, obligations and liabilities will be assumed by the purchaser. The purchaser of course has to conduct due diligence investigation on the subject company to make sure that it is buying what it really wants. The parties should then work on an agreement for sale and purchase of shares to stipulate items like price, completion date, warranties and representations by the seller, indemnity for tax liabilities, limitation of seller’s liability, etc. Depending on the size and complexity of operation of the subject company, the entire sale and purchase process can be very complicated and could take months to complete. Since this is not an easy task to go through the entire sale and purchase procedure without professional assistance, the purchaser and seller will be taking considerable risks if they do not engage professionals like accountant and lawyer in the process.

回答:創辦小型企業可能是一個富有挑戰性和令人興奮的體驗。但是閣下不妨考慮不要從零開始建立業務,而是購買現有並已在運作中的業務。 收購現有並已在運作中的業務,優勢是顯而易見的。

僅舉幾例:產品或服務已經在市場上,品牌可能已成熟,啟動時間可以顯著縮短,可能更容易獲得融資,已有穩健的客戶群等。買方只需評估它願意為收購業務付出多少,並找到一個願意以雙方同意的價格出售業務的賣家。 收購現有業務最直接的方式是收購經營該業務的公司的所有股份。公司的全部權利、義務和責任將由買方承擔。當然,買方必須對目標公司進行盡職調查,以確保它購買的業務確屬其真正所需。然後,雙方應達成股份買賣協議,以釐定股份價格、成交日期、賣方的擔保和陳述、納稅彌償責任、賣方責任上限等事項。視乎目標公司的規模和運作複雜性,整個買賣過程可能非常複雜需要數個月才能完成。如果沒有專業協助,要完成整個買賣過程並非易事。因此,如果買方和賣方不委聘會計師和律師等專業人員參與工作,他們將承擔相當大的風險。

Question : INSTEAD OF SETTING UP A NEW BUSINESS, CAN I ACQUIRE AN ON-GOING BUSINESS? WHAT DO I HAVE TO BEAR IN MIND IF I INTEND TO DO THAT? Answer : Starting a small business can be a challenging and exciting experience. However, rather than building a business from ground zero, you may consider purchasing an existing and on-going one. The advantages of acquiring an existing and on-going business are obvious. Just to name a few: the product or service is already on the market, the brand is probably well established, startup time can be significantly reduced, it is probably much easier to obtain financing, access to customer base is secured, etc. The purchaser just has to evaluate how much it is willing to pay for the business and find a seller who is willing to sell at a mutually agreed price. The most straight forward way to acquire an on-going business is to acquire all the shares in the company which runs that business. The company’s entire rights, obligations and liabilities will be assumed by the purchaser. The purchaser of course has to conduct due diligence investigation on the subject company to make sure that it is buying what it really wants. The parties should then work on an agreement for sale and purchase of shares to stipulate items like price, completion date, warranties and representations by the seller, indemnity for tax liabilities, limitation of seller’s liability, etc. Depending on the size and complexity of operation of the subject company, the entire sale and purchase process can be very complicated and could take months to complete. Since this is not an easy task to go through the entire sale and purchase procedure without professional assistance, the purchaser and seller will be taking considerable risks if they do not engage professionals like accountant and lawyer in the process.

買生意大家來說可能是一個陌生的事情,但是有一件事大家可能不會陌生,那就是頂手,一般來說,頂手也會有頂手費,頂手費的產生其實是一種投機現象。

這是提前租好一個商鋪,等這個商鋪以後火了,就會有別的人想再來租。那麼就需要從這個人手裡定租下來,想租店鋪的人就會多交一筆錢。這是最早開始的時候就是,第一個租店鋪的主人,無力經營自己的店,所以想把它轉讓出去,但是又想從中賺錢,所以就在原來的價格的基礎上加錢,雖然加的不多,可能是幾百或者幾千,再租給其他的人,店鋪本身很火,所以想要求租的人很多,就造成求大於供的局面,如果店鋪足夠好的話,會有一些專門的人來租店鋪,專門從中賺取頂手費。現在這種情況已經成為行業內的潛規則了。

在這個潛規則當中,很多人就利用頂手費這個項目來獲取暴利,有很多的創業者可能因為店鋪的原因,不得不放棄。因為在很多城市繁華的地區,往往會有一鋪難求的現象,所以頂手費是肯定會有的,而且商鋪處的地段越好,那麼就會有越高的轉讓費用。